|

The latest updates on how South Korea is handling it's COVID response, Economics Stimulus Plan, Consumer Trends, and Industry Updates from South Korea ATR Min Lee.

View it here.

0 Comments

Chris Sevcik, Director of International Trade Services, WTCGP All parties, the United States, Canada, and Mexico, have all now approved the USMCA. This allows the deal to move on to the next phase. During this phase, all three countries must work out how they will abide by the obligations outlined in the deal. This phase will require parties to discuss internally and between each other and should take several months. The Trump administration is aiming for an entry-in-to-force by June. While this is not impossible it is very ambitious. The USMCA is on course to be implemented, but it will take time before it is fully enacted.

Chris Sevcik, Director of International Trade Services, WTCGP President Trump signed the USMCA today. The USMCA aims to build on NAFTA by strengthening the alliance and ensuring all parties benefit. Mexico has already ratified the agreement. Canada, long insisting it would wait for US approval before proceeding, still must ratify the new agreement and then Canada, Mexico and the US must meet their obligations before the deal takes effect.

The US International Trade Commission estimates that “USMCA would raise U.S. GDP by $68.2B and us employment by 176,000 jobs.” They go on to state that “US exports to Canada and Mexico would increase by $19.1B (5.9%) and $14.2B (6.7%), respectively.” This projected increase in GDP and jobs for Americans allowed for the Senate to pass the bill overwhelmingly with an 89-10 vote. Major areas of change:

Approved with bi-partisan support, USMCA will benefit companies across North America, create jobs and boost GDPs. Chris Sevcik, Director of International Trade Services, WTCGP The US and India are working towards a bilateral free trade agreement that is meant to ensure both parties benefit and targeted industries expand. A trade pact, described as a “mini-deal,” could come as soon as President Trump’s next visit to New Delhi scheduled in the coming weeks. This could restore India’s preferential trade status and ease US concerns with India’s trade and economic practices.

American companies are looking at expanding their operations in India, and 200 companies have expressed their interest to move from China to India. As supply chains continue to shift, a US-India free trade agreement can help companies in both countries expand their partnerships and grow. Forty products imported from the US into India have been identified including pistachios, walnuts and apples for duty concessions so far. Medical devices, steel and aluminum are still under negotiation. The mini-deal will likely not include a decrease in trade tariffs. Reductions should be addressed in subsequent negotiations to ensure companies in both countries are able to have better market access for their products. While both parties are aligned in their ambitions to develop a free trade agreement, tech policy is an issue that could be a potential deal breaker. There are currently three main hurdles that could cause issue: India’s Personal Data Protection Bill, India’s E-Commerce policy and their Intermediary guidelines. India’s Personal Data Protection Bill was formally approved on December 4th by the Cabinet. If passed, the bill could impose strict data localization measures and establish a new Data Protection Authority to enforce compliance requirements with monetary penalties for those companies found to be uncompliant. Should this bill be passed, it may cause potential issues for international companies and potentially cause the US-India Free Trade Agreement to derail. India’s E-commerce policy is being revisited by the Ministry of Commerce and Industry. The new policy could require the disclosure of source code and introduce broad restrictions limiting pricing strategies of multinationals. The MOCI has suggested that these new policies could be completed by mid-2020. If this policy is enacted, US companies would have to hand over their source code, a potential deal breaker for a U.S. India Trade Agreement. India’s intermediary guidelines are about to be updated. This update will impact social media firms including Facebook. The updates are currently under review but are expected to include a mandatory traceability requirement. This requirement, if enacted, would force companies to break end-to-end encryption and create backdoors into their code. India claims that traceability is needed to ensure the safety of its citizens; however, privacy advocates are worried that the government could track down critics and impact free speech. Many companies, government officials and individual citizens see a US-India Free Trade agreement as a benefit to both India and the US; however, there are still several hurdles that must be cleared before it can take effect. By Chris Sevcik, Director of International Trade Services, WTCGP The US is expected to sign a trade deal with China today. This deal is the first phase of a larger trade deal that is expected at a later date. News of the deal has been well received by markets with the Dow Jones crossing 29,000, an all-time high.

The US-China trade dispute originated as a dispute over intellectual property. Intellectual property is addressed in the phase one deal. China will crackdown on policies concerning forced technology transfer and address other barriers for entry. Enforcement of intellectual property is also included in the phase one deal. Should an issue arise and the US trade representative receives a complaint, it will be adjudicated within 90 days. If the US trade representative does not feel the issue was addressed properly, the US has the right to impose a proportionate response and China has promised that it will not retaliate. The US-China phase one trade deal will also include the agreement by China to open its financial services sector to US firms. This opening up will account for much of the increase in services to be purchased by China from the US. In this deal, China has also agreed to “refrain from deliberately pushing down its currency to gain a trade advantage.” This will allow US companies to compete on a more level playing field in the Chinese market. With China agreeing to not deliberately adjust its currency, the US has also dropped the currency manipulator label placed on Beijing. China has also agreed to increase purchases of US goods and services. In the first phase of the trade deal, it has been announced that China has agreed to purchase a roughly $200B in US goods. Of this $200B purchasing agreement, approximately $75B will come from manufactured goods, $50B from energy, $40B from agriculture, and $35B from services. There is discussion, however, regarding how this agreement will become reality. The increase in manufactured goods will likely come from the purchase of aircraft, autos, and auto parts. With the 737max grounded, however, there may be an issue in aircraft purchases until this issue has been resolved. Most American automotive OEMs have manufacturing bases in China. The most popular vehicles produced in the US and sold in China include SUVs from BMW and Mercedes. With limited supply, it is questioned how increases will be forthcoming. There are several roadblocks that may impact the effectiveness of this agreement. The auto industry in China has cooled off in recent years. China car sales are down and excess domestic capacity is rising. This, combined with no changes on high tariffs placed on US-made autos, procurement rules favoring Chinese manufacturers or subsidies to Chinese state-owned enterprises, means that increasing the sale of US-made autos remains in question. There has been discussion regarding China’s demand for increased agricultural products. In 2017, China spent $24B on US farm goods. Is China’s demand for US farm goods nearly double today as it was two years ago? Experts are skeptical and with the recent strong increase of purchases of soybeans from Brazil by China in the past week, skepticism remains high. China economy has slowed in recent years. As its economy slows, demand for energy decreases. Energy analysts are questioning if China will have the need to purchase an additional $50B in energy products. Sourcing for crude oil, liquefied natural gas and liquefied petroleum gas (LPG) has been established and it is unlikely that a large increase in energy products will be required soon. The slowdown in China’s economy may not impact all sectors exporting from the US. China recently has reduced tariffs, issued rate cuts to fuel lending, and has “called on local governments to ‘go to all lengths’ to prevent massive job losses.” In the short-term, if the Chinese economy is pushed into a ballooning scenario, imports will be required from multiple sectors to continue pushing out products. Imports will also be required as the domestic population continues to consume. In the long term, however, this will not be sustainable. Phase one of the US-China trade deal still has several hurdles to cross, but with the inclusion of intellectual property protection, the opening up of the financial sector, and the agreement to increase purchasing of US goods and services, many companies will find doing business in China much easier. by Chris Sevcik, Director of International Trade Services The United States and China have agreed to move forward with the phase one trade deal. As both sides continue to negotiate the final details of phase one, no new tariffs will be implemented. The deal is expected to be signed by both parties in January.

The postponement of the tariffs was expected by most observers. Neither side wanted to implement the newest round of tariffs as it would impact virtually every product made in China including electronics and toys during the Christmas buying season in the United States. Businesses on both sides of the Pacific are eager to see a signed trade deal in the near future and welcome the postponement of tariffs. Key points of the phase one trade deal include: a reduction of existing tariffs, increase agriculture sales to China and discussing enforcement of intellectual property. Keen on coming to an agreement soon, China and the United States are working on addressing these matters in preparation for a final signing in January. We will be posting updates as this story develops. By Chris Sevcik, Director of International Trade Services, WTCGP The healthcare market in China continues to increase. In 2017, the market value was $761 billion and it is expected to reach $1.19 trillion by 2020 and then $2.39 trillion by 2030. Growth is fueled by an aging population, an expanding middle class and advancements in medical technology. As the market continues to develop, opportunities for US firms expand.

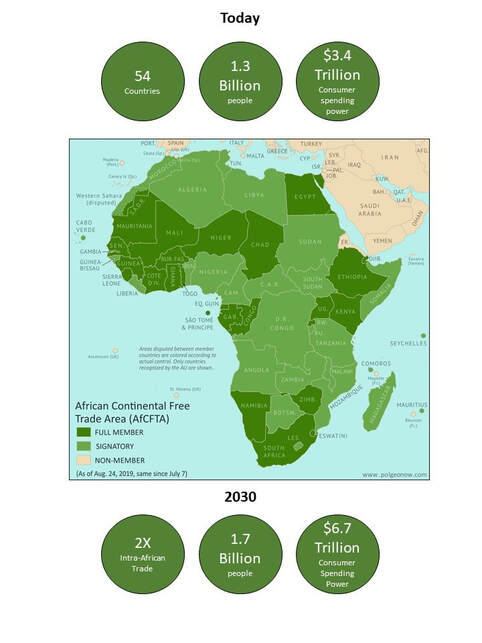

Entering the Chinese market may seem like a daunting task, but the market is forecasted to continue its strong growth over the foreseeable future. As long as you are innovative and a cost competitor, the Chinese market place should not be an issue for growth says Dr. John Bennett, CEO of Devon International Group. The main pillar of China’s healthcare service plan is increasing private capital in the healthcare system. This will be achieved through the development of private hospitals or through public-private partnerships as China has indicated that it will curb large-scale public hospital expansions. From 2013 to 2018, private hospitals have had a compound annual growth rate (CARG) of 13.1% while public hospitals had a growth rate of -2%. While the growth rate of public hospitals was negative during this time, public funding has become more concentrated and now targets improving the existing public hospitals over constructing new ones. In 2018, public hospitals spent more than $350 billion, and it is projected that by 2022 the market value will be 71% higher than 2018 levels. In order to ensure sufficient funding, China is promoting public-private partnerships. The Chinese government is also removing restrictions on foreign investors owning and running private hospitals and is encouraging that they participate in restructuring public hospitals; however, they have warned against a rush to sell-off state-owned hospitals to private entities. Some foreign entities have developed private hospitals in China, but a large structural shift towards private hospitals is yet to develop. By Chris Sevcik, Director of International Trade Services, WTCGP The African Continental Free Trade Agreement (AfCFTA) now includes 54 of Africa’s 55 states and creates a $3.4 trillion economic zone of 1.3 billion people. The AfCFTA allows for free movement of investments, business travels and creates a customs union to attract long-term investments and streamline trade. The goal of the AfCFTA is to increase international trade, but moreover expand intra-African trade. Currently much of African trade must flow from a domestic African country to Europe or the Middle East and then back to an African Country rather than directly moving within the continent. The challenges of transporting goods across boarders consumes an abundant amount of time and resources. One prominent businessman in Philadelphia commented that it is cheaper and faster to ship products from China to Philadelphia than it is to ship products from Nigeria to Sierra Leon.

By Chris Sevcik, Director of International Trade Services, WTCGP

The RCEP is a free-trade pact among 16 countries: the ten ASEAN members and India, China, Australia, New Zealand, Japan and South Korea. RCEP member states make up almost half of the world’s population at 3.4 billion people and their combined GDPs account for about 39% of total global GDP at 49.5 trillion dollars. The region includes some of the fastest growing economies in the world, and as they continue to grow, it is projected that the region’s GDP will be 250 trillion dollars by 2050. The RCEP is not finalized. Currently India has reservations on joining the RCEP. In the past, some citizens in India perceived that some of their prior trade deals were not ideal for India and the current government is keen on ensuring that this perception is not mirrored this time. Members of the RCEP would like to see India join as they are one of the largest economies in the region and are poised to be a major growth area for years to come. Regardless of India’s involvement, other RCEP member states have expressed that they are ready to move forward with or without India’s involvement. India understands the benefits that this trade deal could bring to their economy and they are cautiously moving forward; however, they are acting as a stronger negotiator in this new deal. China needs better access to Indian markets more than India needs access to China markets. India is standing its ground and not offering many concessional tariff lines to China in order to try and stem an onslaught of Chinese duty-free goods. While this may work today, factories have been moving from China to Southeast Asia and have recently increased due to the US-China trade dispute. These factories will have preferential trade agreements with India and this may serve as a backdoor for Chinese goods in the future. The rules of origin will be an area of contention as negotiations continue. The RCEP has been described as China’s answer to the Trans-Pacific Partnership, TPP. The TPP was led by US efforts while the RCEP is led by China and the plans outline the different leading countries’ stances. The TPP was more ambitious and included regulations on labor, intellectual property and state-owned companies in addition to providing market access for goods and services. The RCEP does not address issues such as regulations on labor, intellectual property or state-owned companies and focuses more narrowly on standardizing tariffs in the region while improving marketing access for services and investment. The RCEP should increase regional trade when complete. There are issues with the plan currently and India is working on ensuring that their interests are upheld in the final agreement. When the agreement is finalized, this new trading block will represent the largest and fastest growing countries and region in the world. Understanding this agreement will better ensure companies of their future success. By Chris Sevcik, Director of International Trade Services, WTCGP

The US and China recently signed a limited trade deal addressing US farm goods, Japanese machine tools and digital trade. The limited trade deal is meant to mirror the Trans Pacific Partnership (TPP), and according to a senior administration official, “help producers keep pace with foreign competitors who are increasing sales in Japan now that the 11-nation TPP is in effect, without the US.” The new US-Japan trade deal is designated as limited since it does not address automotive tariffs. The United States had threatened to enact Section 232 of the Trade Expansion Act of 1962 that would allow the US to place tariffs on autos in the name of national security. With the limited trade deal, Japan trusts that the US will not pursue the tariffs so long as the agreement is faithfully implemented by Japan. The current limited trade agreement will reduce or eliminate tariffs on US cheeses, processed pork, poultry, beef offal, ethanol, wine, frozen potatoes, oranges, fresh cherries, egg products and tomato paste. The agreement will also prohibit customs duties on digitally transmitted music, software and videos. The limited trade agreement is only the first phase of a more comprehensive agreement, according to the Trump administration. “In the fairly near future, we are going to be having a lot more, very comprehensive deals, signed with Japan,” President Trump remarked. US Trade Representative, Robert Lighthizer, explains that the US and Japan were expected to meet next April for the next round of negotiations and both sides will revisit the issue of automotive tariffs at that time. The US-Japan trade agreement, initiated over a year ago, had run into issues earlier in the week when Japan wanted assurance that President Trump would not initiate Section 232 tariffs. While the United States did not expressly say that they would not initiate the tariffs, it is understood that as long as both parties faithfully implement the limited trade deal, Section 232 tariffs will not be imposed. |

Our Trade NewsWhere you can get the most recent updates about international trade from our staff and other experts. Archives

June 2020

Categories |

RSS Feed

RSS Feed